A modern-looking bank or credit union website is only the beginning of crafting an ideal user experience that will meet your financial goals. This week, we’re going to take a look at five website features and functions that are essential for financial institutions.

- Responsive Design for Banking on the Go

- Consumer Tools to Empower Your Customers

- Calls to Action to Drive Sales

- Online Applications to Close the Deal

- A Location Finder for Building Personal Relationships

Responsive Design for Banking on the Go

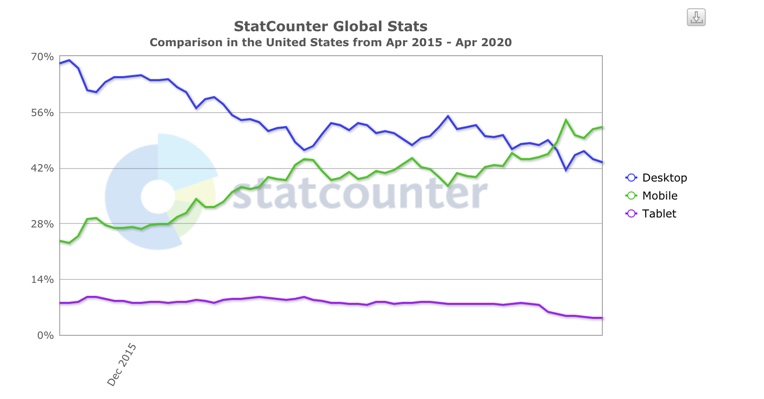

According to StatCounter, as of April 2020, only 43.5% of Americans use desktop computers to go online versus 52.3% who use mobile.

Source: StatCounter Global Stats – Platform Comparison Market Share

Since 2015, desktop usage has fallen more almost 25%, and mobile usage has increased almost 20%. With this in mind, you must design your bank website from a mobile-first standpoint. Mobile- or digital-first bank website design is responsive. With this type of design, your website reformats to fit the screen of whatever device your customer is using to view it. This allows your customer the flexibility to conduct business with your bank wherever they may be.

Consumer Tools to Empower Your Customers

The Consumer Financial Protection Bureau is a government agency that encourages consumers to educate themselves before making financial decisions. You can empower your customers by providing financial tools on your bank website.

In addition to creating and posting how-to guides that they can download, you can offer rate calculators and quizzes so customers can discover which of your products or services can best meet their needs.

Calls to Action to Drive Sales

Once a customer visits your bank website, your goal should be for them to act. This might be as simple as contacting you for more information or going as far as opening a new account online. To convert a visit into a sale, you need to include specific calls to action.

Don’t be vague by using terms like “Click here.” Be as specific as possible so your customer knows what to expect with the next step, such as “Apply for an auto loan,” “Locate a branch near you,” or “Open an account.”

Online Applications to Close a Deal

Your bank can’t be open 24/7, but your website can be. Your customers may not live by your operating hours or schedule, so you want to offer banking on their terms. Online applications and the ability to submit personal information securely are must-haves if you want to compete with both local and online financial institutions. Just make sure your web hosting provider has the proper security and privacy measures in place to safeguard your customers’ information.

A Location Finder for Building Personal Relationships

Your bank website is a modern convenience that allows your customers to conduct business with you whenever they need to. However, building a strong, personal relationship with your customer never goes out of style.

Sometimes your customer needs to talk to a representative at a branch or withdraw cash from an ATM. Your website should include a page or even separate pages dedicated to each of your locations. Integrate a Google map and make your phone number or email address clickable so customers can easily connect with you. Also, list your hours of operation so customers don’t waste their time stopping by when you’re closed. Lastly, incorporating a location finder on your website also boosts your SEO rankings.

Final Words

If your bank or credit union website doesn’t contain these five must-have features, now might be a good time for a redesign. BankSITE® Services designs responsive websites that are also ADA compliant. You have the option to link to or license any of our more than 50 calculators to place directly on your site. We also have self-tests that will link your customer to the appropriate secure online application. Let us help you convert visits to your website into long-lasting relationships with your customers.